Do platinum and palladium follow golds performance in a recession?

Ever wonder whether platinum and palladium behave like gold during tough economic times? It’s a question many investors and traders ask when trying to diversify their portfolio or hedge risks. As market turbulence becomes more commonplace, understanding how these metals move in a downturn can be the difference between riding out a storm or sailing straight into one.

In times of economic slowdown, investors tend to flock to assets that have historically shown resilience. Gold is the poster child, often shining brightest when uncertainty hits the markets. But what about platinum and palladium? Are they the same, or do they dance to a different tune? Getting a grip on this can unlock smarter investment decisions—whether youre trading forex, stocks, crypto, or commodities.

Gold’s Recession Playbook: The Benchmark

Gold has a long reputation as a safe haven. When the economy shrinks or stocks wobble, gold tends to rise as confidence wanes in other assets. Its liquidity, wide acceptance, and intrinsic value make it a steady anchor. Think of it like a weather vane—when markets get stormy, gold often points directly to safety. That’s why traders keep a keen eye on gold’s behavior during downturns.

Platinum and Palladium: The Rarity and Their Market Dynamics

While gold is often the default safe haven, platinum and palladium bring more complexity to the table. Both are precious metals, but their demand largely hinges on industries—auto manufacturing for palladium and catalytic converters for platinum. When the automotive sector hits a rough patch, these metals can behave quite differently from gold.

-

Platinum: Known as the "King of Metals" due to its rarity, platinum tends to mirror industrial demand more than investor sentiment. During a recession, if automakers cut production, platinum prices can drop sharply, unlike gold which might hold steady or even strengthen.

-

Palladium: Also tied closely to auto manufacturing, especially diesel and hybrid vehicles. In a recession, palladium’s performance can mirror that of platinum, often declining in tandem or even more sharply if demand contracts. But, at times, supply disruptions or novel technological shifts can cause unexpected rallies.

Do They Follow Gold’s Lead?

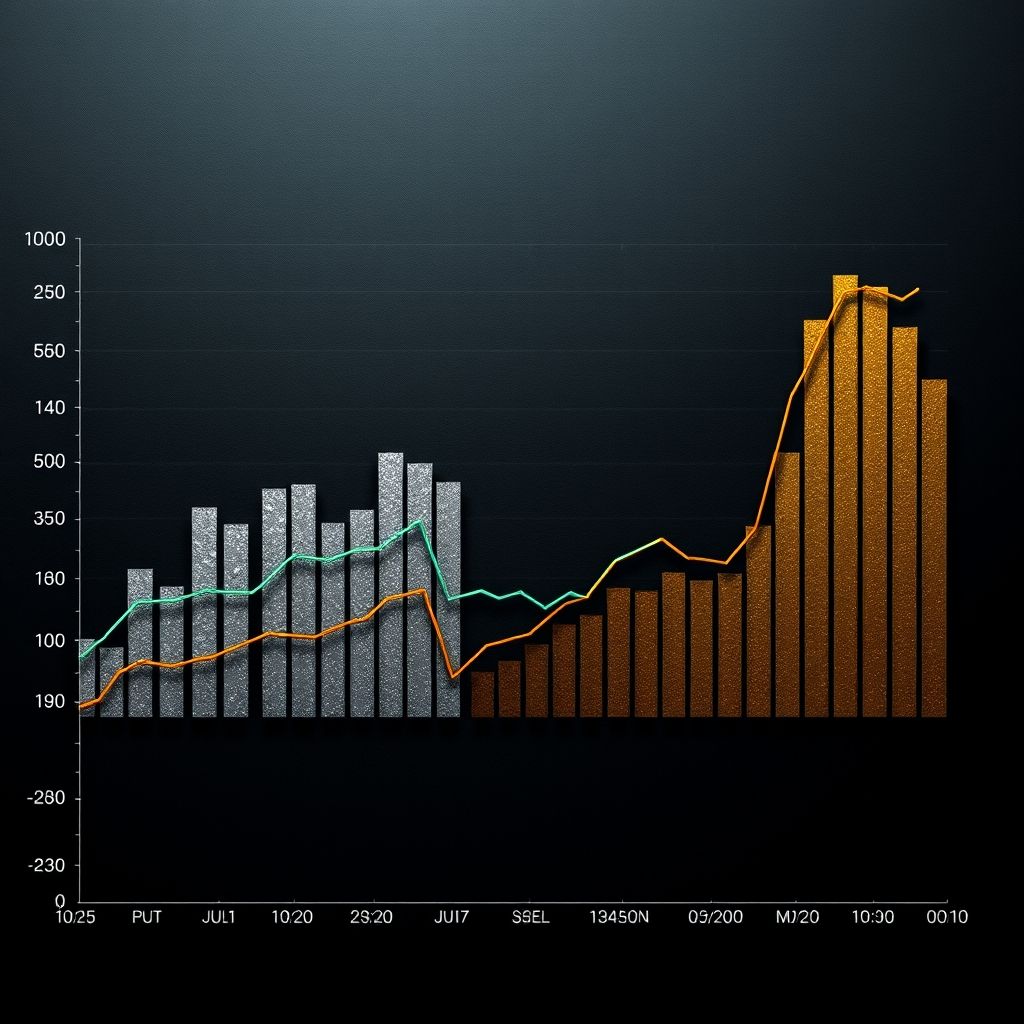

Looking at historical data, platinum and palladium don’t always follow gold’s lead during downturns. Gold’s safe-haven status is pretty consistent, but platinum and palladium are more sensitive to industry cycles and supply shocks. For example, during the 2008 financial crisis, gold surged, but platinum and palladium experienced more volatility, with platinum falling sharply and palladiums behavior being more mixed depending on industry data.

Fast-forward to today’s market, where tech innovations, shifting industry fundamentals, and the emergence of digital assets are changing the game. The rise of decentralized finance (DeFi), AI-driven trading algorithms, and smart contracts are transforming how traders approach metals. Whether you’re trading on traditional platforms or exploring crypto-backed assets, understanding the fundamental behavior of these metals remains key.

Looking ahead, gold’s status as a safe haven might remain unchallenged, but platinum and palladium could find new roles—especially if sustainable tech and clean energies boost demand. The challenge? Navigating these shifts requires a keen eye on supply chains, technological trends, and macroeconomic signals.

Investment Strategies & Cautionary Notes

When trading metals in volatile environments, leverage can amplify your gains—and your losses. Using smart tools like AI-driven analysis or real-time charting can give you an edge, especially in fast-moving markets. For instance, considering a smaller leverage ratio during recession periods might reduce risk exposure, while employing options strategies can hedge against unexpected downturns.

In the realm of decentralized finance, digital tokens backed by precious metals are gaining attention, offering liquidity and transparency. But beware—security concerns, regulatory changes, and technology hurdles remain. Exploring blockchain-based assets requires a solid understanding of both the underlying tech and market dynamics.

The Road Ahead: Trading in a New Era

The future hints at a more integrated, tech-driven approach—think AI predicting market swings, smart contracts executing trades automatically, and decentralized platforms fostering transparency. But with innovation comes new challenges—regulatory uncertainty, technical vulnerabilities, and market maturity.

One thing’s clear: whether you’re betting on gold, platinum, palladium, or the next-generation digital assets, staying informed and adaptable is your best move. Keep an eye on supply chain shifts, industry demands, and technological advances, and your trading strategy will be better equipped to weather any market storm.

Because in the end, diversifying your assets is like having a well-rounded toolbox—ready for whatever the market throws your way.

Feel free to dive deeper into any of these aspects—after all, understanding how platinum and palladium play their roles during economic slumps might just be your secret weapon in a rapidly evolving financial landscape.