What is divergence in mathematics?

What is Divergence in Mathematics?

Introduction

Divergence is not just a mouthful from a calculus class. It’s a simple idea with real bite: it measures how much stuff is “flowing out” of a region. Think of a sponge soaking up water or a river delta letting water spill outward. In math terms, divergence of a vector field gives you a scalar field that tells you where sources and sinks sit in space. In this article, we’ll unpack the concept, show practical insights, and connect it to modern prop trading, DeFi, and the AI-driven future of finance.

Divergence in a Nutshell

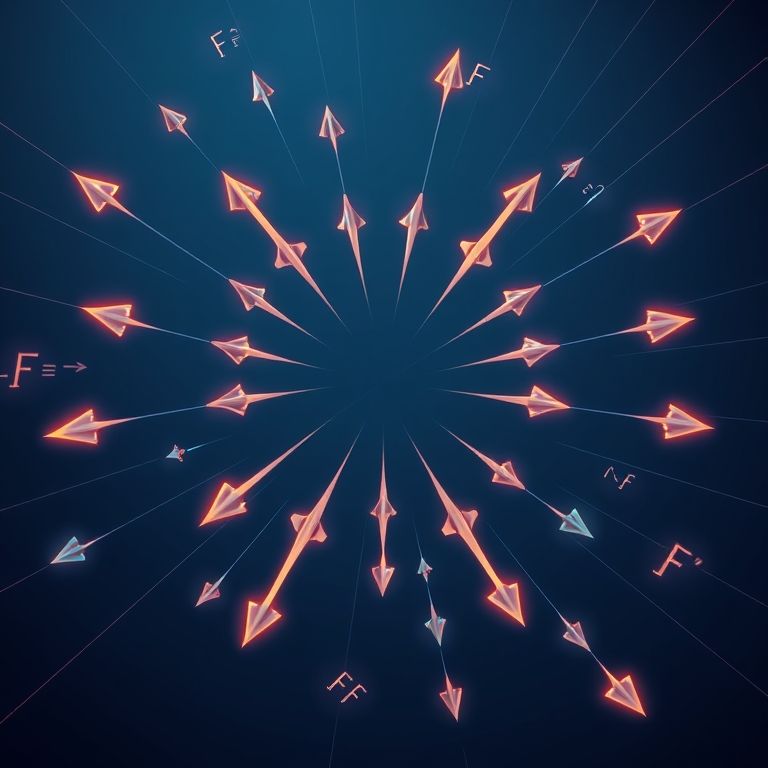

- What it is: For a vector field F = (F1, F2, F3) in three dimensions, the divergence is div F = ∂F1/∂x + ∂F2/∂y + ∂F3/∂z. It’s the net outward flux per unit volume.

- How to read it: Positive divergence marks a source (things are emanating outward); negative divergence marks a sink (things are converging inward). A zero divergence suggests a balance—no net creation or destruction of flow in that region.

- A helpful example: In 2D, F = (x, y) has div F = ∂x/∂x + ∂y/∂y = 2. Everywhere, there’s a steady outward tendency, a simple cue of a uniform source.

Key points you can feel

- Local vs global: Divergence looks at an infinitesimal neighborhood, but Gauss’s theorem links it to what happens on a boundary. That bridge—away from the point to the whole region—matters for modeling flows.

- Intuition in motion: If you imagine a field representing liquid velocity, positive divergence means “more water leaving than entering here,” which translates to rising pressure or spreading flow in a real system.

- Simple checks: If a velocity field points outward from every point in a region, expect positive divergence inside; if it points inward, expect negative.

Divergence and Finance: a Signal for Flows

- What it can metaphorically tell you: In markets, “flow” matters. Liquidity, order flow, and capital movement resemble a field where divergence hints at where money is being injected or pulled back. This isn’t about price alone but about the movement of orders, liquidity, and risk across a space of assets or timescales.

- Practical use: Features inspired by divergence-like ideas can accompany time-series models to detect expanding liquidity pockets or crowded preferences across pairs, futures, and tokens. It’s a way to quantify how trading activity diverges from a local equilibrium, not a magic predictor but a signal to watch.

Prop Trading across assets

- Advantages: A unified math lens helps across forex, stocks, crypto, indices, options, and commodities. When you spot regions of net inflow or outflow in order book heatmaps or liquidity metrics, you can refine entries and risk controls with more context.

- Cautions: Divergence is a diagnostic tool, not a crystal ball. Markets are noisy; calibration and robustness matter. Pair mathematical intuition with solid risk limits and backtesting across regimes.

DeFi, Decentralization, and Challenges

- The DeFi wave brings transparent, programmable markets, but it also raises complexity: smart contract risk, oracles, and liquidity fragmentation. Divergence-inspired concepts are still useful here, helping you frame liquidity sources and exit paths in automated markets and yield strategies.

- Barriers: Security audits, reliable data feeds, and cross-chain interoperability remain the gating factors. The promise sits alongside real execution risk and governance trade-offs.

Future Trends: Smart Contracts, AI, and Prop Trading

- Smart contracts: Automated, rules-based trading on trust-minimized rails can implement divergence-aware strategies at scale, from market making to statistical arbitrage.

- AI-driven trading: Machine learning thrives on features that summarize flows and flux. Divergence-like signals can feed anomaly detection, regime change alerts, and adaptive risk controls.

- Prop trading’s trajectory: Institutions and shops that blend mathematical intuition with robust risk controls, diversified assets, and smart contract-enabled execution stand to gain from faster, more transparent liquidity discovery and tighter optimization loops.

Slogan and takeaway

Divergence in mathematics clarifies where things push outward and where they pull in—a compass for traders riding multiple markets. “Divergence: map the sources of price movement, not just the echoes.” As DeFi matures and AI sharpens, divergence-inspired thinking can help you spot true liquidity, manage risk, and stay agile in a fast-changing landscape.